9. Proposal Budget

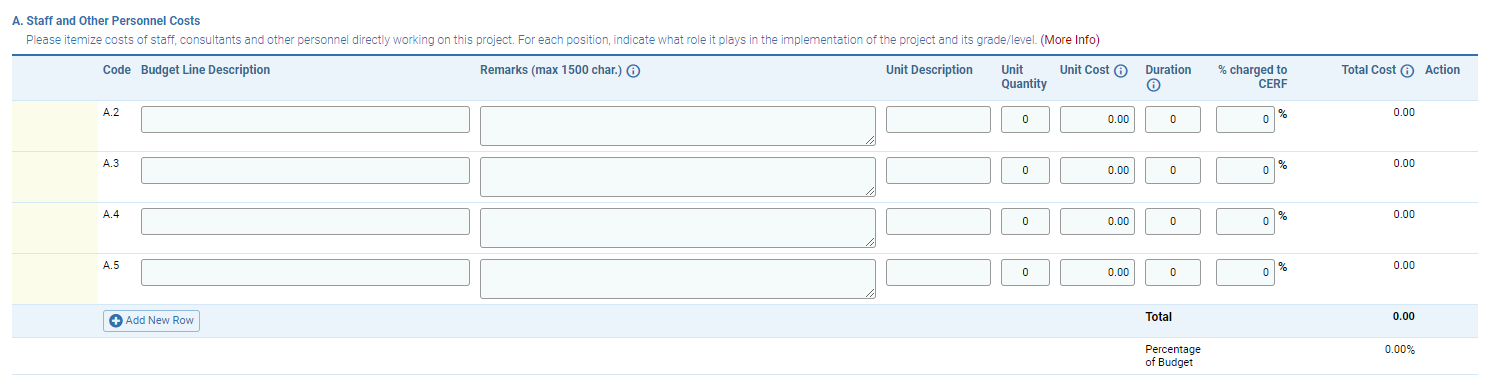

A. Staff and Other Personnel Costs

B. Supplies, Commodities, Materials

C. Equipment

D. Contractual Services

E. Travel

F. Transfers and Grants to Counterparts

G. General Operating and Other Direct Costs

10. Budget by Sector / Cluster

11. Budget Value References (Programming and Cash and Voucher Assistance)

OneGMS Tips: building a good budget

The ‘Budget’ tab allows the user to enter all project budget line items that sum up to give the total project budget, amounting to the grant requested to OCHA. It should reflect activities described in the project narrative. Budgets should be designed, with consideration for the project’s implementation period., taking into account the project’s implementation period.

The Budget page allows the user to enter all project budget line items.

The “total” field of all line items will add up to the total project budget requested from OCHA.

You may add new rows by clicking on the [Add New Row] button at the bottom of each Budget category. You may add up to the limit of 50 items per category.

To fill the ‘Budget’ tab, you will need to enter a remark per budget line item as well as unit type, unit quantity, unit cost, duration and percentage charged to OCHA. At the bottom of the tab, you will find a category to modify the sectors/clusters’ budget percentage. By default, the system provides five rows but can add new rows by clicking on the [Add New Row] button at the bottom of each Budget category. You can add up to the/a limit of 50 items per category.

Wherever possible and relevant, please provide a sufficiently detailed breakdown of items (unit, quantity, unit costs, % charged to CERF) for each budget line.

Where a breakdown of unit, quantity and unit cost is impractical or irrelevant, please provide the total amount of the item, along with sufficient description of cost elements.

Budget Categories

The budget is broken down into 7 budget categories labeled A-G. Each budget category section is broken down by identically named fields displayed in the image above, but the information you input in the fields will vary based on budget category.

A. Staff and Other Personnel Costs

Under this budget category, you can itemize costs relating to staff, consultants and other personnel recruited directly by the organization for the implementation of the project. You can indicate whether staff are national or international, as well as their level, title, role, number, and the unit cost of each position.

Please note: CERF does not fund salaries of Government staff.

B. Supplies, Commodities, Materials

Under this category you can itemize direct and indirect costs of consumables to be purchased under the project (e.g., medicines, food, non-food items, tents, seeds, tools, etc.), including associated transportation, freight, storage, and distribution costs (e.g., customs, insurance, warehousing, and other logistical requirements) and communications materials for training and awareness raising (e.g., posters, pamphlets, etc.).

If a consumable is in the form of a kit, you can briefly describe the content of the kit in the Remarks field.

For lump sum lines, please describe the calculation in the Remarks field.

C. Equipment

Under this category you can itemize costs of non-consumables to be purchased under the project (e.g., medical equipment, IT equipment for registrations, etc.). Only equipment directly related to the implementation of the project will be considered.

Please note: CERF generally does not fund the purchase of vehicles, heavy equipment, or construction equipment which is not of a temporary nature.

D. Contractual Services

Under this category you can list work and services of a commercial nature to be contracted under the project. Please provide the names of contractors, if known.

Please note:

• Consultant costs should be listed under category A expenses. (Staff and Other Personnel Costs).

• Budget for Government partners or NGOs should be listed under category F expenses. (Transfers and Grants to Counterparts).

E. Travel

Here you can itemize the travel costs of staff, consultants, and other personnel (e.g., airfare, daily subsistence allowance (DSA), hazard pay, etc.) associated with project implementation.

F. Transfers and Grants to Counterparts

This budget category will be populated with data you enter in the ‘Subgrants’ page of the project proposal form.

Please note: only the Remarks field will be editable in this budget category. Other fields in the budget category can be amended from the ‘Subgrants’ page. To delete a budget line in this category, you may/can do so/this from the ‘Subgrants’ page.

Costs allowed to be incurred by partners include the following:

Costs allowed to be incurred by partners include the following:

• The cost of personnel recruited by the sub-implementing partner to perform services sub-contracted by the partner.

• Direct operational costs necessary for delivery of services (e.g., commodities, supplies, transportation).

• Other direct costs needed to implement services/works for this project such as general operating and office running costs. You can hover over the ‘handshake’ icon (![]() ) to display the name of the sub-implementing partner.

) to display the name of the sub-implementing partner.

G. General Operating and Other Direct Costs

Under this category, please add general operating expenses and other direct costs for project implementation, such as office rental costs, stationery and supplies, utilities (telecommunications, internet, etc.), the rental of vehicles and all other costs that cannot be included in the categories above.

Please note:

• CERF does not fund recurring costs of regular Agency operations and programmes, such as regular Agency security costs, costs associated with Minimum Operating Security Standards (MOSS) compliance, or contributions to UN common services.

• In the office rental line, please include the office’s location.

• For training, please further itemize component costs. For instance, for training events which involve hiring consultants to design and deliver the training, and to procure conference packages, consultant costs should be listed under category A. (Staff and Other Personnel Costs), and the conference cost, listed under category D. (Contractual Services).

Budget field descriptions

- Code: The line code is automatically generated and first identifies which of the 7 budget categories (A-G) the item belongs to followed by a numeric identifier to refer to the budget line number.

- Budget Line Description: Provide the description relating to the respective budget line as relevant/Provide the budget line description based on the category it falls under (e.g. job title for staff, item of type of equipment, mode of transportation and purpose of travel, general operating expense) the response to this field varies slightly based on budget category:

- Remarks: enter all necessary remarks on the budget line item, including the type, unit, amount, duration, and cost of the budget line, as when as any specific details (title and grade of a position, destination/duration/purpose/DSA of a travel, location of the expense) For lump sum lines, please describe the calculation in this field. If relevant, include a general breakdown of the budget. Details of the budget may be presented in annexes.

- Unit Description: Indicate the unit type of the item (e.g., person/items/service/type of good/tickets for travel).

- Unit Quantity: Enter the number indicating the quantity for the line (e.g., how many staff-members/the numbers of consumable supplies/number of pieces of equipment/etc.

- Unit Cost: Enter the cost in USD of each item.

- Duration: It/This can be expressed in months, days, or you can enter “1” for lump sum. Please clarify what unit of time you are using in the “Remarks” field.

- % charged to CERF: Enter the percentage to be charged to CERF. All categories are expected to showcase 100% coverage by CERF except for category A where the shared/share covered can vary from 0 to 100%

- Total Cost: This automatically calculated based on the information provided to reflect the total cost to CERF per category.

- Action: Upon saving, the ‘delete’ icon (

) will appear and will allow the user to delete the line by clicking on the icon.

) will appear and will allow the user to delete the line by clicking on the icon.

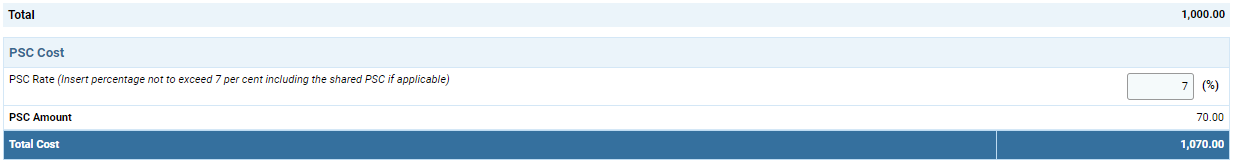

PSC Cost and Total Cost

Below the budget categories, the Indirect Project Support Cost (PSC) includes PSC at headquarters, at the regional, or at country level. The user must enter the PSC rate which should not exceed 7% of the total project direct costs. The PSC amount will be automatically calculated and displayed below the PSC rate. The PSC amount includes the sub-IP PSC. You can hover over the ‘information’ icon (![]() ) to display the sub-IP and its PSC rate.

) to display the sub-IP and its PSC rate.

The Total Cost is calculated by the system, adding up the total project budget and the PSC.

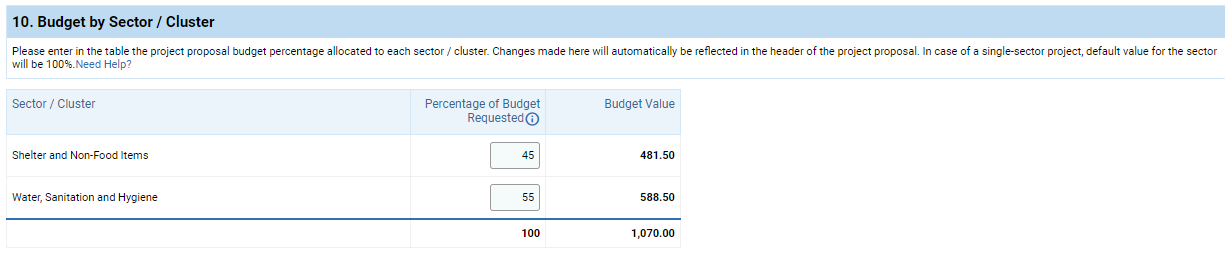

10. Budget by Sector / Cluster

Please enter in the table the project proposal budget’s percentage allocated to each sector / cluster. Changes made here will reflect in the project header if saved.

For multi cluster projects, the combined project percentages must be equal to 100%. For single-cluster projects, the default percentage will be 100% for the sector.

Fields description/Field Descriptions:

- Sector/Cluster: the name of the sector/cluster of the project.

- Percentage of Budget Requested: enter the percentage of the project’s total budget allocated to the cluster.

- Budget Value: the budget value corresponding to each percentage will automatically be displayed by the system.

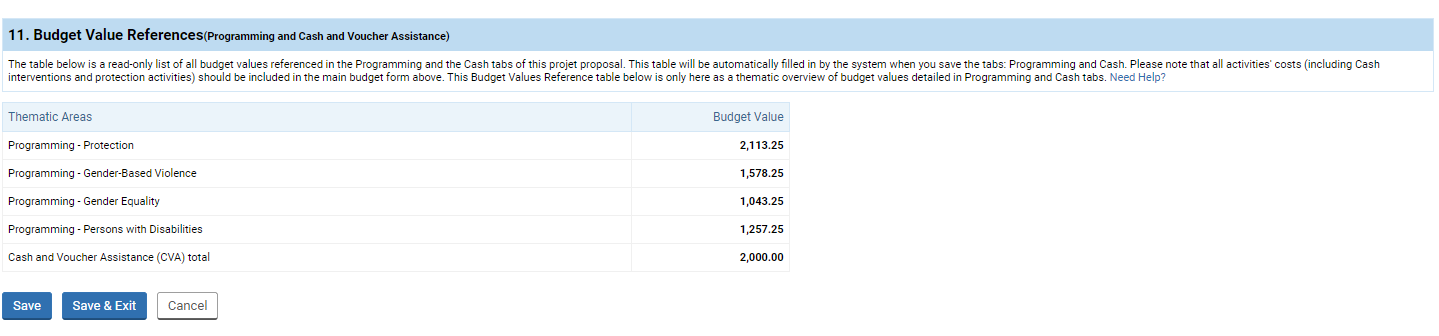

11. Budget Value References (Programming and Cash and Voucher Assistance)

This category features a read-only table, which will be populated by information you enter in the ‘Programming’ and ‘Cash’ pages of the project proposal form.

Please note: all activities’ costs/activity costs (including cash interventions and protection activities) should be included in the main budget form above. This Budget Values Reference table below is only here as a thematic overview of budget values detailed in the ‘Programming’ and ‘Cash’ tabs.

OneGMS Tips: building a good budget

A checklist to build a good budget:

- The budget should be submitted through OneGMS

- In the Remarks section, provide details on budget line description, unit quantity, unit cost, duration, time units (months, days or lump sum), percentage charged to the fund and the total per budget line.

- The meaning of a "unit" should be indicated in the description, e.g. Kg, tons, boxes, assisted people etc.

- Itemize each national and international staff, consultants and other personnel by function and provide unit quantity and unit cost by monthly or daily rates for each staff position. -

- Provide unit or quantity (e.g., 10 kits, 1000 metric tons) and unit cost for commodities, supplies and materials to be purchased. The budget narrative should be used to account properly for specifying the applicable unit of reference (length, volume, weight, area, etc.).

- Provide technical specifications for items whose unit cost is greater than US$10,000.

- Provide breakdown of costs for items whose total cost is greater than US$10,000. The breakdown of costs can be added through the OneGMS Documents tab of the project under ‘Budget document’ type. This breakdown should be in an excel sheet.

- Provide technical specifications for those items whose unit costs can greatly vary based on those same specifications (e.g., for generators, a reference to the possible range of power would be sufficient to properly evaluate the accuracy of the estimated cost).

- Provide details in the budget narrative for contract so that the object of the contract results clearly identified.

- Itemize general operating costs (e.g. office rent, telecommunications, internet, utilities) for project implementation providing quantity and unit cost. A lump sum for operating costs is not acceptable.

- Cost-shared staff positions whose existence is intended to last the entire duration of the project should be charged for the entire period and charged in percentage against the project (half of the cost of a guard, in a 12 months project, should be budgeted at 50% of the monthly salary for 12 months). Durations shorter than the project are acceptable only if the position is not intended to last for the entire duration of the project. When recording expenditures, the partner will retain the possibility to do it, within the budgeted amount, according to the modalities that better suits its preferences (charging 100% of the guard for 6 months). This should be calculated as a percentage against the overall amount of the shared cost and charged in percentage to the project.

- It is preferable to charge shared costs for the entire duration of the project. When recording expenditures, the partner will retain the possibility to do it, within the budgeted amount, according to the modalities that better suits its requirements (e.g.: to cover half of the rent of an office in a 12 months project, the partner should budget the rent for 50% of the monthly cost for 12 months period. Then the partner retains the possibility to pay the full rent of the office for 6 months with the allocated budget).

- Estimates can be accepted in travel, as long as the calculation modality of the estimate is described reasonably in the budget narrative (e.g., providing estimates on the number of trips and average duration in days, daily subsistence allowance (DSA) rates, etc.).

- Provide the list of items included in kits whose individual value is equal to or less than US$50.

- Provide list of items and estimated cost per item for kits whose individual value is greater than US$50.

- Provide the list of items for globally standardized kits (this does not include standard kits agreed upon in each country) like Post-exposure Prophylaxis (PEP) kits, Interagency Emergency Health Kit (IEHK2011), etc.

- In the case of construction works, only the labor costs and known essential materials shall be budgeted and itemized, providing unit/quantity and unit cost. The budget narrative should explain how construction costs have been estimated on the basis of a standard prototype of building (latrine, health post, shelter), type of materials (wood, prefabricated, brick/cement/concrete) and formula or rationale used to estimate construction costs (e.g. per square foot or meter, previous experiences, etc.).