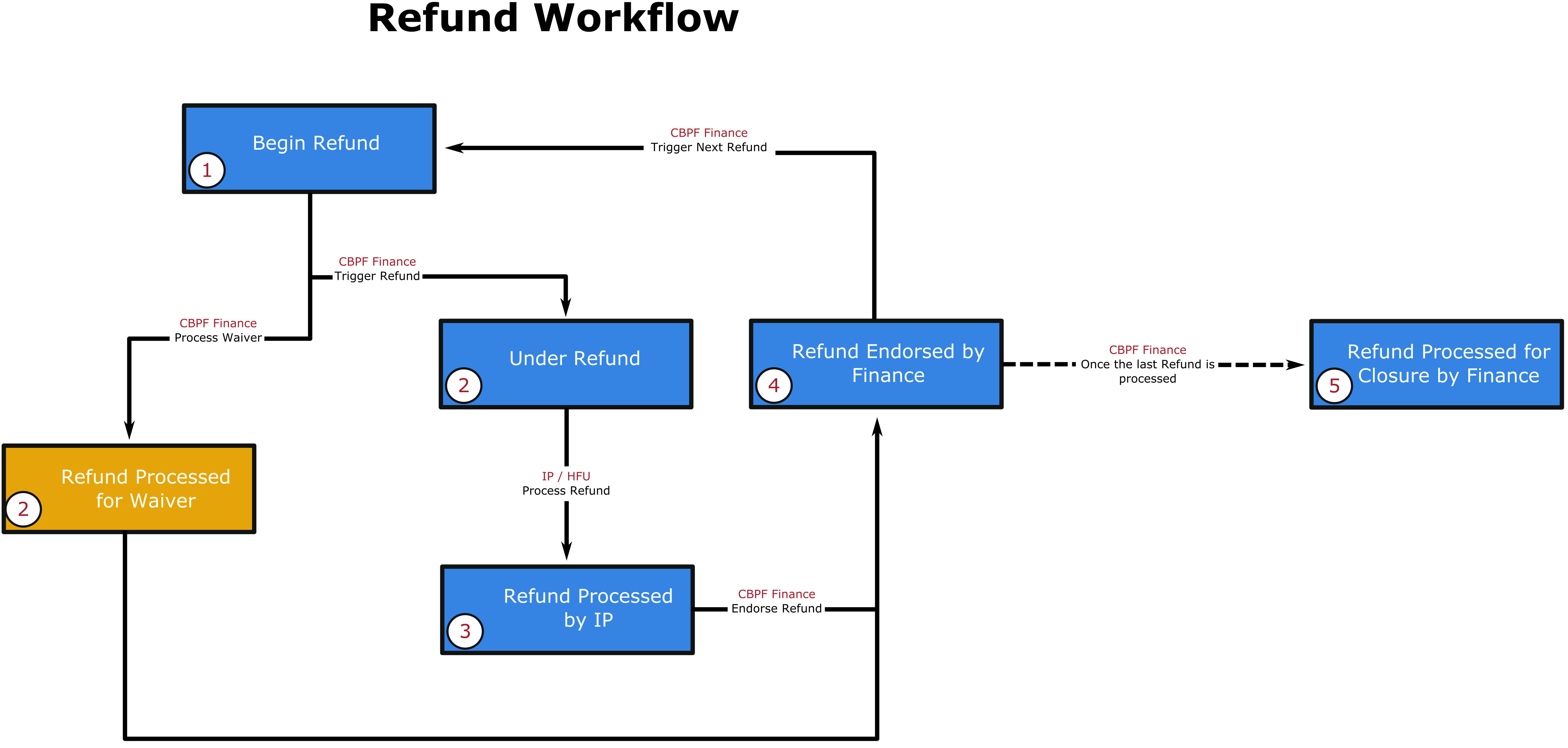

- When is a Refund activated

- How to activate a Refund (Finance HQ)

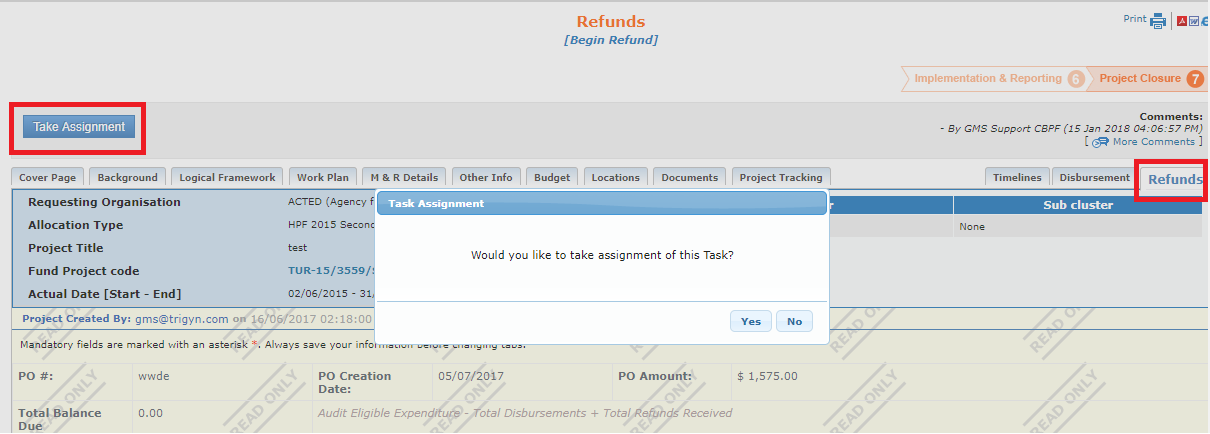

- How to trigger a Refund request (Finance HQ)

- How to process a Refund (Implementing Partner)

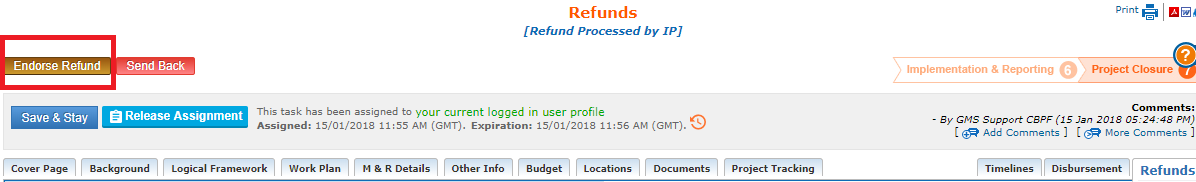

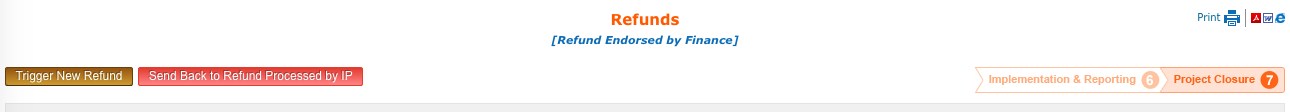

- How to endorse a Refund (Finance HQ)

In a normal workflow, Refund can be triggered after the Final Financial report is completed and approved and refund is due by the partner, according to the expenditure report submitted (scenario 1). The project will be open for Refund once the Audit has been completed (scenario 2).

CBPF Finance

If a Refund needs to be activated before the Audit has been completed, CBPF Finance can do so by accessing the ‘Project admin` tab on the project page.

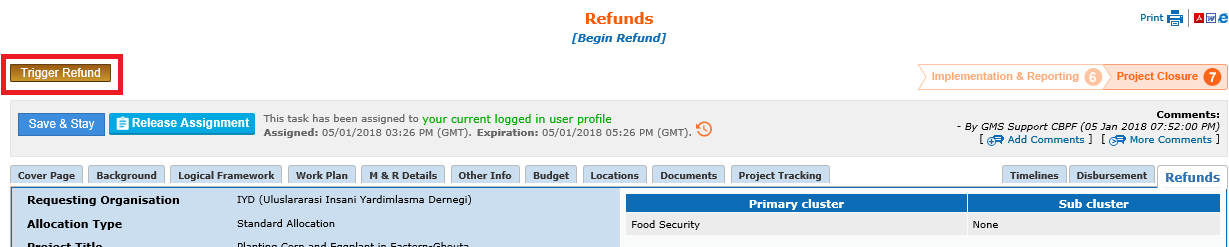

In a normal workflow, the refund process will start after the Audit process has been completed. The [Begin Refund] button will be available on the project page once the Audit has been finalized, if CBPF Finance clicks on the button [Audit received – proceed refund] upon finalization of the Audit report.

How to trigger a Refund request

On selecting the project and accessing the ‘Refunds’ tab, GMS will prompt whether the user will be taking the assignment of this task. The assignment of entering Refund data is assigned to the user for approximately 2 hours If the task is not completed in the time frame it’s released automatically. It can also be released manually by clicking on the [Release Assignment] button.

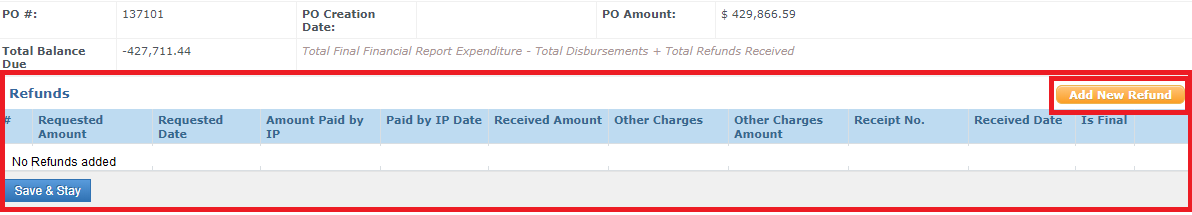

CBPF Finance will then need to click the [Add New Refund] button, which will create a new line in the ‘Refunds’ section (as many lines as refunds requested).

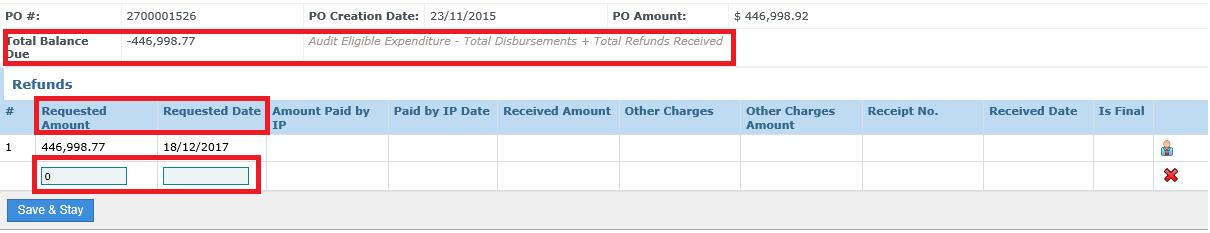

- Requested amount: Displays the Refund amount requested by CBPF Finance based on the following formula: Audit Eligible Expenditure - the Total Disbursements + the Total Refunds Received.

- Requested date: Displays the date on which the refund is requested by CBPF Finance.

- Amount Paid by IP: Displays the actual amount paid by the partner (considers the partner’s local currency)

- Paid by IP Date: Displays the date in which the partner paid the refund.

- Received Amount: Displays the amount that was received by CBPF Finance.

- Received Date: Displays the date in which CBPF Finance received the refund.

- Other Charges: Displays different charges that would explain the difference between the ‘Amount Paid by IP’ and the Received Amount’. Such charges could be the following: Bank Fee, Exchange Gains, Other Charges, UNDP Chargers.

- Other Charges Amount: Displays the amount of the ‘Other Charges’.

- Receipt No.: Displays the number of the payment.

- Is Final: Displays if the refund is final.

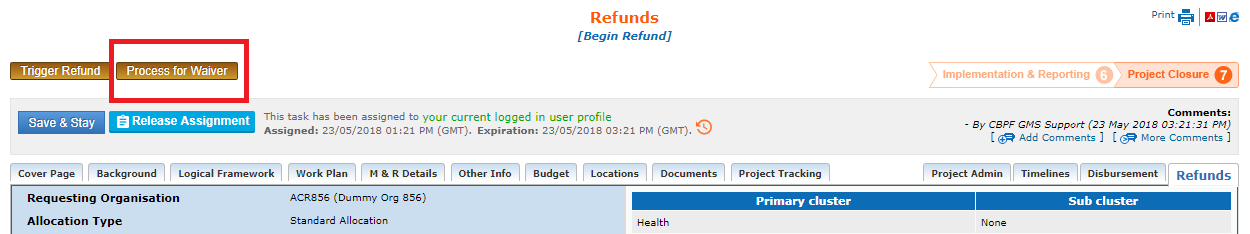

*Please Note: button will be visible only to CBPF Finance users, if Balance is lesser than $75.

After entering the “Requested Amount” and “Requested Date”, and upon clicking on the [Process for Waiver] button, CBPF Finance users must fill in the four last fields (“Other Charges”,”Other charges Amount”, “Receipt No.”, “Received Date”). The fields “Amount Paid by IP”, “Paid by IP Date” and “Received Amount” will be locked to the user. CBPF Finance will then be able to finalize the refund by clicking on [Endorse Refund] button.

icon of the project on the partner’s home page or go to the ‘Refunds’ tab in the project page.

icon of the project on the partner’s home page or go to the ‘Refunds’ tab in the project page.